How Taxes Really Work: What Every Small Black Business Owner Should Know

- Thomas Ford

- Oct 4, 2025

- 3 min read

💡 Let’s Start With the Basics

Every year, businesses and individuals in the United States pay federal taxes on the money they earn after expenses, which means profit, not total income.

If you make $100,000 in your business but spend $40,000 running it, you’re only taxed on $60,000 because that’s what you actually earned.

But here’s where it gets confusing for most people: taxes aren’t one flat rate. The government uses something called a progressive tax system, which means the more you earn, the higher the percentage you pay on just that top portion.

🏢 It Also Depends on What Kind of Business You Have

Sole Proprietor / Single-Member LLC: You and your business are the same for tax purposes. You pay income tax and self-employment tax (which covers Social Security and Medicare).

S-Corporation: You pay yourself a salary, which gets taxed normally, and then you can take extra profits as “distributions” that usually have a lower tax rate.

C-Corporation: The company itself pays a flat 21% corporate tax, and then you (the owner) pay taxes again when you take money out as dividends. It’s called “double taxation,” but some larger businesses use this setup for flexibility.

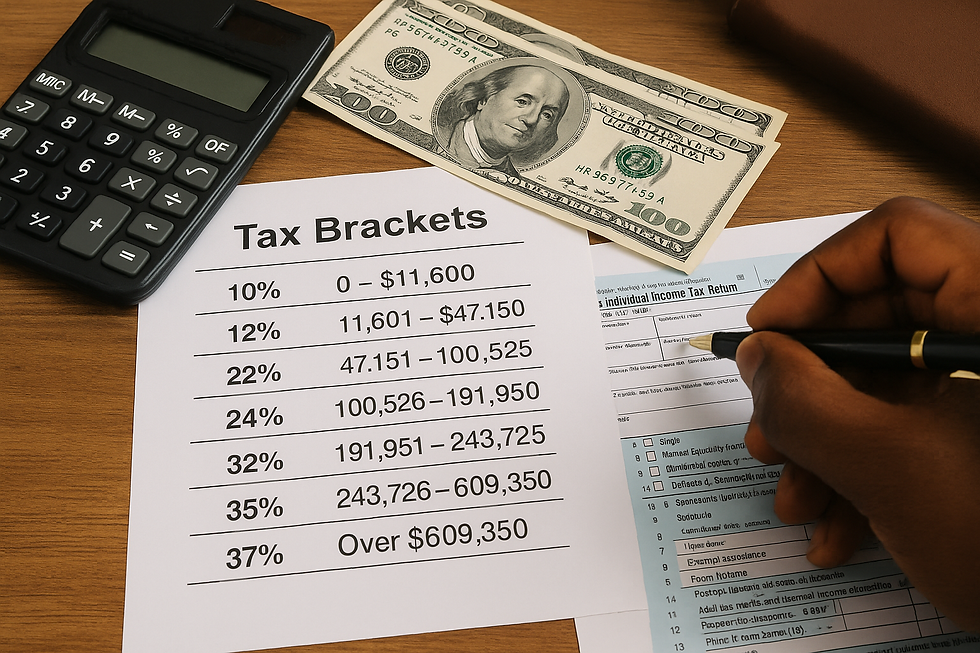

💵 The Federal Tax Brackets: How Much You Pay Per Dollar

Here’s the 2025 tax bracket for individuals but it’s the same concept whether you file personally or through your business profits.

Tax Rate | Income Range |

10% | $0 – $11,600 |

12% | $11,601 – $47,150 |

22% | $47,151 – $100,525 |

24% | $100,526 – $191,950 |

32% | $191,951 – $243,725 |

35% | $243,726 – $609,350 |

37% (Top Rate) | Over $609,350 |

Now here’s the trick: you don’t pay that rate on all your money. You pay each rate only on the part of your income that falls in that bracket.

🧠 Breaking It Down Like You’re 12

Let’s say your business made $649,000 in profit this year.

You don’t pay 37% on all $649,000.You pay it in layers, like this:

The first $11,600 gets taxed at 10%

The next $35,550 gets taxed at 12%

The next $53,375 gets taxed at 22%

The next $91,425 gets taxed at 24%

The next $51,774 gets taxed at 32%

The next $365,624 gets taxed at 35%

And only the amount over $609,350 (in this case $39,650) gets taxed at 37%

So even though you’re in the 37% bracket, your average tax rate is only around 30% overall.

That’s what people mean when they say “effective tax rate”, it’s the average amount you really pay per dollar, not just the top bracket you fall into.

💰 What About Self-Employment Tax?

If you’re self-employed, you also pay 15.3% to cover Social Security and Medicare. That breaks down like this:

12.4% for Social Security (only on the first $168,600 you make)

2.9% for Medicare (on everything)

And if you make over $200,000, there’s a small extra 0.9% for high earners.

So if you’re running your own business, you’ll pay income tax + self-employment tax, which together often total around 25–30% of your profit.

💼 So How Much Should You Set Aside?

If you don’t have a tax accountant yet, here’s a rule that will save you a lot of stress:

👉 Set aside 30 cents for every $1 of profit you make.

That 30% will almost always cover your federal income tax and self-employment tax — and usually leave you with a little extra cushion.

✊🏾 Why This Matters for Black-Owned Businesses

Many small Black business owners start with great products and big dreams, but get caught off guard by tax season. Understanding how taxes actually work gives you power and protection. It means you’re building your business on a strong foundation, not just hustling, but planning.

When we understand money, we control money. When we control money, we build generational wealth.

🧾 Final Takeaway

Taxes aren’t your enemy they’re a tool you can learn to manage.

Know your profit, not just your sales.

Learn your brackets, so you know what to expect.

And pay yourself first by setting aside that 30%.

Knowledge is the new currency. And financial literacy is the bridge between survival and success.

Comments